- What is EV/Invested Capital?

- How to Calculate EV/Invested Capital?

- EV/Invested Capital Formula

- EV/IC Multiple: Industry Cyclicality and Capital Intensity

- EV/Invested Capital Calculator

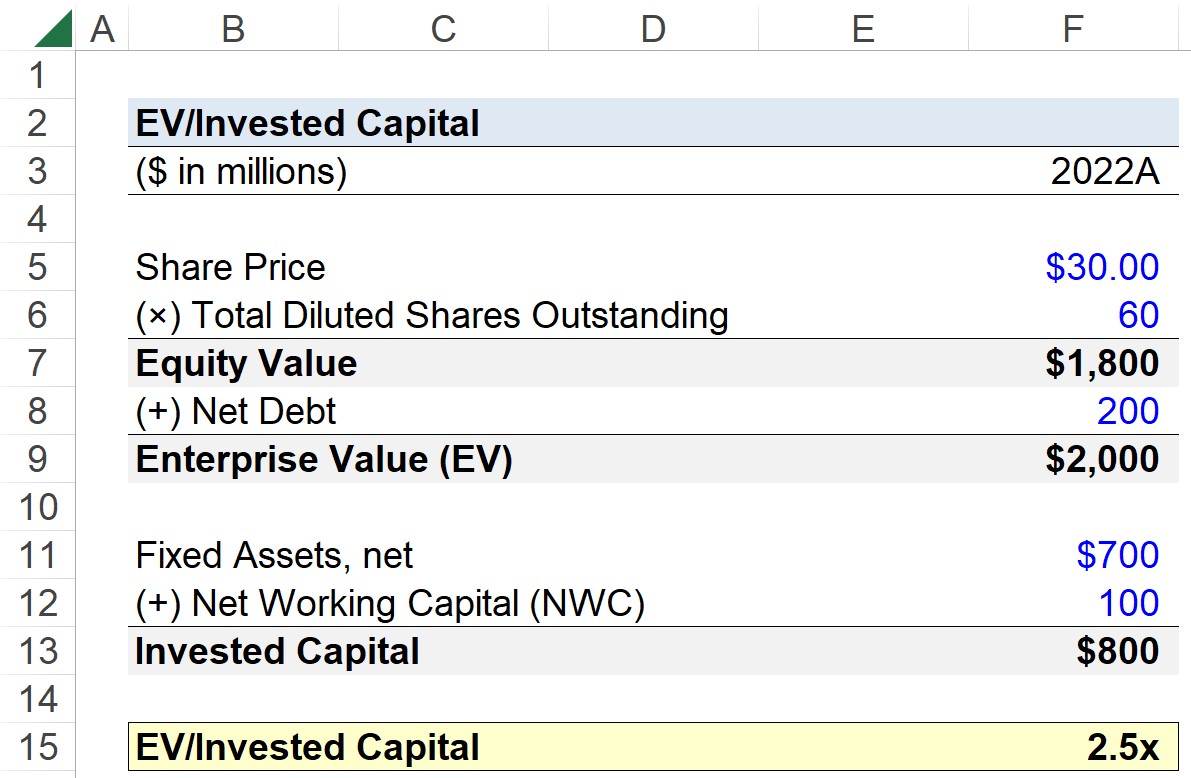

- Step 1. Enterprise Value Calculation (EV)

- Step 2. Invested Capital Calculation (IC)

- Step 3. EV/Invested Capital Calculation Example

What is EV/Invested Capital?

EV/Invested Capital is a valuation multiple that compares the enterprise value of a company in relation to its invested capital, i.e. the sum of fixed assets and net working capital (NWC).

How to Calculate EV/Invested Capital?

The EV/Invested Capital (EV/IC) multiple is the ratio between a company’s enterprise value and its invested capital.

- Enterprise Value (EV): The enterprise value (EV), the numerator of this multiple, represents the value of a company’s operations from the perspective of all stakeholders, i.e. all group(s) of capital providers.

- Invested Capital (IC): The invested capital (IC), the denominator of this multiple, refers to the total fixed assets and net working capital (NWC) belonging to the company.

The numerator and denominator in a valuation multiple must match in terms of the represented stakeholders, e.g. debt lenders, preferred stockholders, and/or common shareholders.

Since the invested capital (IC) metric – i.e. the sum of a company’s fixed assets and net working capital (NWC) – pertains to all providers of capital, the rule is met.

The EV/invested capital multiple can be thought of as the enterprise value of a company, expressed on the basis of each dollar of invested capital – i.e. the capital provided by its stakeholders – spent on fixed assets (i.e. capital expenditure) and net working capital (NWC).

Learn More → Enterprise Value Quick Primer

EV/Invested Capital Formula

The formula to calculate the EV/invested capital multiple is as follows.

- Enterprise Value (EV) = Equity Value + Net Debt

- Invested Capital (IC) = Fixed Assets + Net Working Capital (NWC)

Note that there is an alternative calculation of the EV/IC multiple, where “Invested Capital” is the sum of total shareholders’ equity and total debt.

- Invested Capital (IC) = Total Shareholders’ Equity + Total Debt

In that case, the EV/IC multiple describes enterprise value on the basis of each and every dollar provided by shareholders and lenders, whereas the prior method – where invested capital is the sum of a company’s fixed assets and net working capital (NWC) – only accounts for the spending on operating items that actually drive future revenue generation.

EV/IC Multiple: Industry Cyclicality and Capital Intensity

Compared to other enterprise value multiples, such as EV/EBITDA or EV/EBIT, the EV/invested capital multiple is not used as frequently.

The enterprise value to invested capital multiple is most applicable to companies with capital-intensive business models, in which its historical and future revenue generation stems primarily from the productivity of its fixed asset base.

The EV/IC multiple remains more stable in periods of cyclicality when the cash flows and earnings of an entire industry – most often in capital-intensive industries such as oil and gas (O&G) – fluctuate substantially.

While other valuation multiples like the price to earnings ratio (P/E) and EV/EBITDA can easily become distorted from the prevailing market conditions, the EV/IC multiple has historically proven to be a more independent (and thus a more reliable) measure of the state of current market pricing.

EV/Invested Capital Calculator

We’ll now move on to a modeling exercise, which you can access by filling out the form below.

Step 1. Enterprise Value Calculation (EV)

Suppose you’re tasked with calculating the EV/Invested Capital of a manufacturing company given the following assumptions.

- Latest Closing Share Price = $30.00

- Total Diluted Shares Outstanding = 60 million

- Net Debt = $200 million

The equity value of the manufacturer can be determined by multiplying the share price by its total diluted share count, which comes out to $1.8 billion.

- Equity Value = $30.00 × 60 million = $1.8 billion

Next, adding net debt to the company’s equity value results in an enterprise value (EV) of $2 billion.

- Enterprise Value (EV) = $1.8 billion + $200 million = $2 billion

Step 2. Invested Capital Calculation (IC)

For our assumptions regarding invested capital, we’ll assume the manufacturer has an outstanding fixed asset balance of $700 million and net working capital (NWC) of $100 million.

- Fixed Assets, net = $700 million

- Net Working Capital (NWC) = $100 million

The sum of the two items is $800 million, which represents the invested capital portion of the calculation.

- Invested Capital (IC) = $700 million + $100 million = $800 million

Step 3. EV/Invested Capital Calculation Example

Upon dividing the manufacturer’s enterprise value (EV) by its invested capital (IC), the resulting EV/invested capital multiple is 2.5x.

- EV/Invested Capital = $2 billion ÷ $800 million = 2.5x

Everything You Need To Master Financial Modeling

Enroll in The Premium Package: Learn Financial Statement Modeling, DCF, M&A, LBO and Comps. The same training program used at top investment banks.

Enroll Today